Coinbase Points to further downtrend in Cryptocurrencies

- tradingfloorresearch

- Jan 23, 2022

- 1 min read

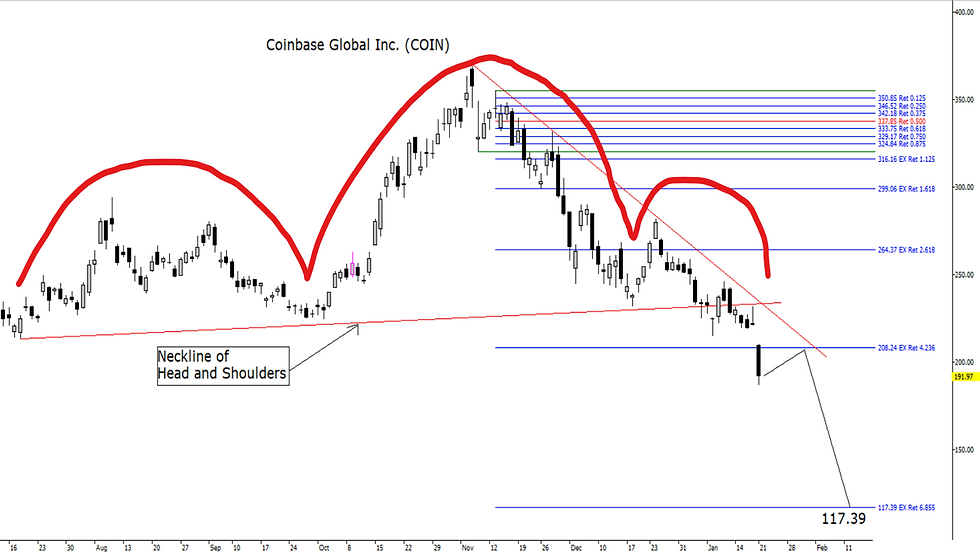

Coinbase Global CL A (COIN) started its downtrend on the first day of trading as an IPO on April 14, 2021. Since then, the stock hit a low of 208 in May 2021 and rallied to a lower high of 368.90 in November 2021. Last week it closed below the 208 low on massive volume. The chart pattern I described is of a lower high and a lower low and is Charles Dow’s primary definition of a downtrend.

In addition to defining a downtrend for the entire trading period, Coinbase Global CL A (COIN) completed a head and shoulders continuation pattern. From the top of the head at 368.90 to the neckline, the swing rule would indicate a downside target at 117.39/share.

This is currently Cathie Wood’s largest holding and is not be a good sign for ARK Invest.

I also believe that Coinbase is a proxy for cryptocurrencies, and a move to 117.39/share indicates a continuation of the downtrend in cryptocurrencies.

Comments